CRYPTOCURRENCY

Futures, Stop Order, PoW

Here is a comprehensive article on cryptocurrencies, futures, stop orders, and proof of work (PoW):

The Complex World of Cryptocurrency Trading

Cryptocurrencies like Bitcoin and Ethereum have gained immense popularity in recent years. However, trading these currencies comes with its own set of risks and complexities. In this article, we will delve into the world of cryptocurrency trading, focusing on three key concepts: cryptocurrency futures, stop orders, and proof of work (PoW).

Crypto Futures

Crypto futures are a type of derivative financial instrument that allows traders to speculate on the price of a cryptocurrency over a specified period of time. Similar to traditional futures, cryptocurrency futures give traders the opportunity to buy or sell a cryptocurrency at a predetermined price at a later date. However, due to the volatility of cryptocurrencies, there is an added layer of complexity.

Crypto futures are traded on centralized exchanges like BitMEX and Coinbase Futures, where traders can buy and sell them alongside other users. Crypto futures prices, like traditional futures contracts, are determined by supply and demand.

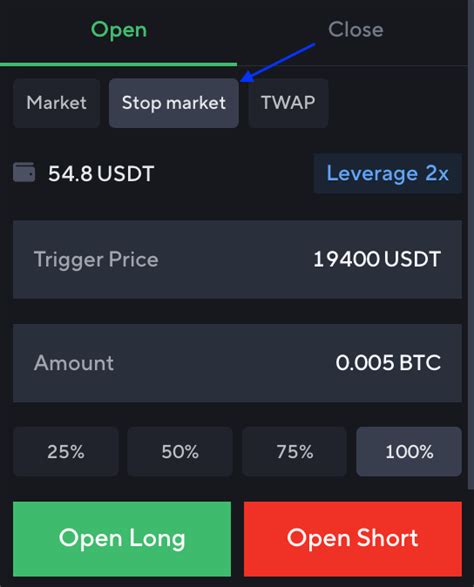

Stop Orders

A stop order is a type of market order that is automatically executed when the price reaches a certain level. It is an essential tool for traders to limit their losses or lock in profits. When you place a stop order on a cryptocurrency, you specify a specific price at which you want to sell or buy it.

For example, if you have a stop-loss order on Bitcoin, you can set it to sell the coin if its price falls below $30,000. This ensures that you will not lose more than your initial investment.

Proof of Work (PoW)

Proof of Work (PoW) is an algorithmic consensus mechanism used by some cryptocurrencies, such as Bitcoin and Ethereum. It is a complex process where miners solve mathematical puzzles to validate transactions on the blockchain.

In summary, here are the steps involved in PoW:

- Miners collect transaction fees: Miners receive a small amount of cryptocurrency in exchange for processing transactions.

- Miners verify transactions

: Miners use complex algorithms to verify transactions and ensure that they follow the rules set by the network.

- Miners solve mathematical puzzles: Miners compete to solve mathematical puzzles that require significant computing power. The first miner to solve the puzzle adds new blocks of transactions to the blockchain.

- New blocks are mined: New blocks of transactions are added to the blockchain, replacing the previous block with a new one.

Challenges and Risks of Crypto Futures, Stop Orders, and PoW Trading

Crypto futures trading, stop orders, and PoW come with their own set of risks and challenges:

- Volatility: Cryptocurrencies are known for their high volatility, making it difficult to predict price movements.

- Liquidity

: Some cryptocurrencies lack sufficient liquidity, making it more difficult for traders to quickly enter or exit positions.

- Market Manipulation: The market is not always fair, and some individuals may manipulate prices by excessively buying or selling.

- Regulatory Risks: Regulatory changes can significantly impact the value of a cryptocurrency.

Conclusion

Trading crypto futures, stop orders, and PoW requires a deep understanding of these concepts and the mechanisms behind them. While they offer traders the opportunity to speculate on cryptocurrency prices, it is important to be aware of the complexities and risks involved. If you are new to trading, it may be wise to start with more liquid cryptocurrencies such as Bitcoin or Ethereum before exploring less volatile options.

Recommendations

- Diversify: Spread your investments across multiple cryptocurrencies and asset classes.

2.

Bài viết liên quan

Understanding The Dynamics Of Trading Ethereum Classic (ETC) And NFTs

Understanding the Dynamics of Trading Ethereum Classic (etc) and Non-Fungible Tokens (NFTS) Cryptocurrency has become a buzzword in the financial world, with many investors flocking to trade digital currencies like...

Identifying Reversal Patterns For Better Trading Outcomes

Identification of inverted models to best trading results in cryptocurrency The world of cryptocurrency trading is known for its high volatility and unpredictable market fluctuations. As a result, investors and...

The Role Of Tokens In Decentralised Finance

Role of chips in decentralized finances (Defi): Financial Future Revolution In recent years, the world has changed significantly in the financial environment. Traditional institutions and mediators have been replaced by...

How Governance Tokens Shape The Future Of Ethereum (ETH)

* Growth of Man Management Tokes and Their Edfecacts of Etreum * In Recentration, The Cyptocurrrency World Has Has Signly Changed the Management Has Been Structred. Traditional Centrolized systems ya...

How Decentralized Finance Is Reshaping Tokenomics

Cryptocurrency and increasing decentralized financing (Defi): How to develop tokenomics In recent years, the world of cryptocurrencies has undergone a significant transformation that is due to the increase of decentralized...

How To Secure Your Investments In Binance Coin (BNB) With 2FA

Secure your cryptocurrency investments with two factors on Binance Coin (BNB) The world of cryptocurrencies has experienced rapid growth and adoption in recent years, making it a popular choice for...

Understanding Market Depth And Its Effects On Trading: A Study On Chainlink (LINK)

Here is a comprehensive article about understanding the depth of the market and its effects on the trade, including a study on Chainlink (Link): Understanding of the market depth and...

The Benefits Of Multichain Strategies In DeFi

Here is a more detailed analysis of the benefits of Multichain strategy in DEFI: What are Multichain strategies? Multichain strategies include the use of many chains (e.g. Ethereum, Solana, Binance...

How To Create A Risk Management Plan For Crypto Trading

Creating a Risk Management Plan for Cryptocurrency Trading The world of cryptocurrency has come a long way since its inception in 2009. With the rise of new technologies and increasing...

Futures Expiration: Strategies For Successful Trading

**Futures Expiration: The Strategies Form. The world off crypto currency trading can be volitile and unpredictable. With the rice off cryptocurrencies such as Bitcoin, Ethereum, and others, the market has...

Understanding Price Action: A Focus On Dogecoin (DOGE)

Understand the price campaign: an approach in Dogecoin (Doge) The world of cryptocurrency has become increasingly complex and volatile in recent years, and prices fluctuate quickly in online exchanges. An...

The Importance Of Community Engagement In Crypto Projects

Here is a break in the importation of community engagement in cryptography projects: What is a community commitment crucial Participation of pre-sale : Many projects holde presale their official bill,...