CRYPTOCURRENCY

Analyzing Trading Volume Patterns For Ethereum (ETH) And Market Trends

cryptocurrency analysis: monitoring of trade volume and market trends for Ethereum (ETH)

The world of cryptographic currencies has increased the popularity of meteoria over the past decade, and Bitcoin (BTC) has been a fee. However, other Altcoins have gained a significant attraction. Among them is Ethereum (ETH), the second largest currency of market capitalization. In this article, we will investigate the Ethereum trade unit patterns in the current state and examine market trends to help investors make informed decisions.

Forms of trade volume

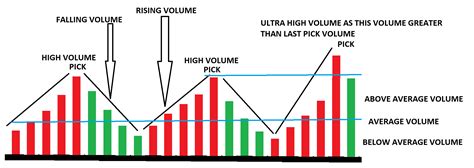

To understand the mood and direction of trade day, traders often look at various price indicators, including the amount of trade. As for Ethereum, here are some key forms of trading that can provide insight into market trends:

- Daily variability : A significant increase in the daily volume of turnover indicates growing interest and trade. However, reduced variability suggests a lack of momentum.

- Medium movable (Mac) Crossover

: When the short-term movable average (EG 50-SHEET) exceeds the long-term movable average (EG 200), it can signal the reversal of the potential trend trend trend trend trend trend or extension.

- Trend trend : Reducing commercial volumes in the amount of growth (e.g. when the price of agriculture trend) may indicate that the trend is the opposite, while increasing the volume of rotation during this process may be a bull.

Trends on the market

Ethereum market trends are influenced by various factors, including regulatory development, acceptance indicators and technological progress. Here are some key market trends for ETH:

- Adoption and adoptive drivers : The growing popularity of decentralized applications (DAPP) in Ethereum has contributed to its growth. Successful DAPP projects can increase demand and then increase the volume of rotation.

- Regulatory environment : The regulatory landscape for the mysterious currency becomes more beneficial, and governments and institutions exceed the adoption of digital assets as a payment agent. This trend can increase the acceptance rates and initiate interest in ETH.

- Decentralized finances (dead) : Defo has gained a significant attraction in Ethereum, with applications such as loan platforms, decentralized exchanges (DEX) and agricultural services. These cases have contributed to the increased volume of rotation.

Technical analysis

To obtain a deeper understanding of Ethereum market trends, technical analysis can be used using various indicators:

- Relative strength indicator (RSI) : High RSI can signal in conditions, while low RSI may indicate conditions.

- Bollinger bands : Extending variability and emptiness in Bollinger bands can help recognize a turning point or continuation of trends.

Application

In summary, the analysis of the size of trade volume and market trends for Ethereum (ETH) can provide valuable insight into the current feeling and direction of the cryptocurrency currency. By identifying key forms of trading volume, such as Mac, reversing trends and adoption controllers, investors can make conscious decisions regarding their positions. In addition, technical analysis techniques such as RSI, Bollinger bands can help identify potential turning points in ETH market trends.

Recommendations

Based on our analysis:

* Long-term investors : Focus on long-term strategies (e.g. 1-3 years) to conduct fluctuations on the market and use the reverse trend.

* short-term traders : Use short-term commercial strategies (EG 5-30 days), using market trends and using price rush.

* Investors aimed at accepting

: priority for adoption of factors such as successful DAPP projects, because they can contribute to a more favorable regulatory environment.

Bài viết liên quan

Understanding The Dynamics Of Trading Ethereum Classic (ETC) And NFTs

Understanding the Dynamics of Trading Ethereum Classic (etc) and Non-Fungible Tokens (NFTS) Cryptocurrency has become a buzzword in the financial world, with many investors flocking to trade digital currencies like...

Identifying Reversal Patterns For Better Trading Outcomes

Identification of inverted models to best trading results in cryptocurrency The world of cryptocurrency trading is known for its high volatility and unpredictable market fluctuations. As a result, investors and...

The Role Of Tokens In Decentralised Finance

Role of chips in decentralized finances (Defi): Financial Future Revolution In recent years, the world has changed significantly in the financial environment. Traditional institutions and mediators have been replaced by...

How Governance Tokens Shape The Future Of Ethereum (ETH)

* Growth of Man Management Tokes and Their Edfecacts of Etreum * In Recentration, The Cyptocurrrency World Has Has Signly Changed the Management Has Been Structred. Traditional Centrolized systems ya...

How Decentralized Finance Is Reshaping Tokenomics

Cryptocurrency and increasing decentralized financing (Defi): How to develop tokenomics In recent years, the world of cryptocurrencies has undergone a significant transformation that is due to the increase of decentralized...

How To Secure Your Investments In Binance Coin (BNB) With 2FA

Secure your cryptocurrency investments with two factors on Binance Coin (BNB) The world of cryptocurrencies has experienced rapid growth and adoption in recent years, making it a popular choice for...

Understanding Market Depth And Its Effects On Trading: A Study On Chainlink (LINK)

Here is a comprehensive article about understanding the depth of the market and its effects on the trade, including a study on Chainlink (Link): Understanding of the market depth and...

The Benefits Of Multichain Strategies In DeFi

Here is a more detailed analysis of the benefits of Multichain strategy in DEFI: What are Multichain strategies? Multichain strategies include the use of many chains (e.g. Ethereum, Solana, Binance...

How To Create A Risk Management Plan For Crypto Trading

Creating a Risk Management Plan for Cryptocurrency Trading The world of cryptocurrency has come a long way since its inception in 2009. With the rise of new technologies and increasing...

Futures Expiration: Strategies For Successful Trading

**Futures Expiration: The Strategies Form. The world off crypto currency trading can be volitile and unpredictable. With the rice off cryptocurrencies such as Bitcoin, Ethereum, and others, the market has...

Understanding Price Action: A Focus On Dogecoin (DOGE)

Understand the price campaign: an approach in Dogecoin (Doge) The world of cryptocurrency has become increasingly complex and volatile in recent years, and prices fluctuate quickly in online exchanges. An...

The Importance Of Community Engagement In Crypto Projects

Here is a break in the importation of community engagement in cryptography projects: What is a community commitment crucial Participation of pre-sale : Many projects holde presale their official bill,...