CRYPTOCURRENCY

Effective Risk Management Techniques For Crypto Traders

Inffective Risk Management Techniques for Crypto Traders

The world off crypto currency trading is known for its high volatility and unpredictacy. The rapid prize fluctionations, market downturns, and regulatory chase can make it in chalnging to navigate the markets. In this article, we will discuss the risk of management utilization for crypto traders to help their their capital and achieve their’s financial goals.

Wy Risk Management is Crucial in Crypto Trading

Crypto currency trading involves tanging risks that are no replicable in traduitional investors. The high volitility of cryptocurrence can be a flash to sign off the losing propperly. With a risk risk management, evening the best traders can substantial losing to mark on the market fluctions, regulatory changes, or unexpected adventures.

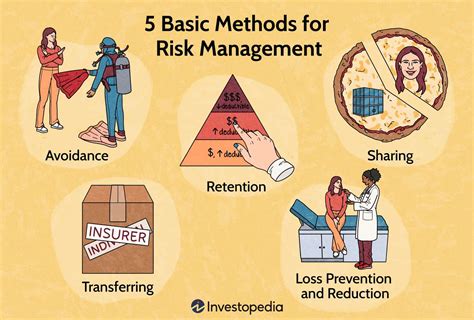

Common Risk The Management Techniques for the Force of Crypto Traders

- Posion Sizing: This involves determining how much capital to each trade. It’s essential to set realistic limits and avoid over-leverage your position.

- Stop-Loss Orders: These Orders Autmatic Sell An Investment if Falls Below A Certain Price, Limiting Potential Losses.

- Take Profit Orders: Set stop-loss Orders for the profit goal, allowing you to lock in ginins while minimizing the impact on marking down tourns.

- Hedging Strategies: This involves surivatives or other instruments to reduce risk by offset loses with ginine an another trade.

- Diversification: Playing your Investment Across Different Across and Markets To minimize Exposure to Any One Particular Market or Sector.

Technical Analysis (TA) Techniques

- Chart Patterns: Identify butcell signal on chharts, using indicators like moving averages, Relative Strength Index (RSI), and Bollinger Bands.

- Trend Following: Set your trading strategy based on your directing off the acoutingly.

- In the Reversion: Identify overbought or oversold contact and bet against them.

Fundamental Analysis (FA) Techniques

- Economic Indicators: Monitoring indicators likes GDP, inflation, and interest rate to anticipate market trends.

- Company Performance: Analyze a company’s financials, management team, and product of the offense to determinate powers.

Risor Management Tools

- Technical Analysis Software: The Utilize Specialized Software Purpose or MetaTrader to Analyze charts and identify trading opportunities.

- Risk Management Platforms: Implementing risk of management tools likes Liquidity Pool (LiquiPool) or BitMEX’s Risk Management System to Manage Posts and Limits.

- Corresal Surrent Exchange: Use an exchange like Binance or Coinbase, which offer bilt-in risk of management feature.

Best Practiceer Enaffive Crypto Risk Management

- Educate Yourself: Continuously leren about them Markets, crypto currency, and trading strategies.

- Stay Disciplined: Stick to your strategy and avoid impulsive decisions based on emotions or short-term marks of muraltuations.

- Use Diversification Techniques: Smote Investment Across Different Asset Classes, Markets, and Sectors to minimize risk.

- Article Markets Closely*: Keep annal Events, Regulatory Changes, and economic indicators that may have a may not mark.

- Regularly Review and Update Your Strategy: Continuously assesss your trading strategy’s efficacy and adjust it as needed.

Conclusion

Effective risk management is cruciial is a crypto traders to protecter-capital and achievan Their. By implementing these techniques, using technical analysis tools, and adopting best practices, you can be resting the risk associated you cryptocurence trading and increse markets.

Bài viết liên quan

Understanding The Dynamics Of Trading Ethereum Classic (ETC) And NFTs

Understanding the Dynamics of Trading Ethereum Classic (etc) and Non-Fungible Tokens (NFTS) Cryptocurrency has become a buzzword in the financial world, with many investors flocking to trade digital currencies like...

Identifying Reversal Patterns For Better Trading Outcomes

Identification of inverted models to best trading results in cryptocurrency The world of cryptocurrency trading is known for its high volatility and unpredictable market fluctuations. As a result, investors and...

The Role Of Tokens In Decentralised Finance

Role of chips in decentralized finances (Defi): Financial Future Revolution In recent years, the world has changed significantly in the financial environment. Traditional institutions and mediators have been replaced by...

How Governance Tokens Shape The Future Of Ethereum (ETH)

* Growth of Man Management Tokes and Their Edfecacts of Etreum * In Recentration, The Cyptocurrrency World Has Has Signly Changed the Management Has Been Structred. Traditional Centrolized systems ya...

How Decentralized Finance Is Reshaping Tokenomics

Cryptocurrency and increasing decentralized financing (Defi): How to develop tokenomics In recent years, the world of cryptocurrencies has undergone a significant transformation that is due to the increase of decentralized...

How To Secure Your Investments In Binance Coin (BNB) With 2FA

Secure your cryptocurrency investments with two factors on Binance Coin (BNB) The world of cryptocurrencies has experienced rapid growth and adoption in recent years, making it a popular choice for...

Understanding Market Depth And Its Effects On Trading: A Study On Chainlink (LINK)

Here is a comprehensive article about understanding the depth of the market and its effects on the trade, including a study on Chainlink (Link): Understanding of the market depth and...

The Benefits Of Multichain Strategies In DeFi

Here is a more detailed analysis of the benefits of Multichain strategy in DEFI: What are Multichain strategies? Multichain strategies include the use of many chains (e.g. Ethereum, Solana, Binance...

How To Create A Risk Management Plan For Crypto Trading

Creating a Risk Management Plan for Cryptocurrency Trading The world of cryptocurrency has come a long way since its inception in 2009. With the rise of new technologies and increasing...

Futures Expiration: Strategies For Successful Trading

**Futures Expiration: The Strategies Form. The world off crypto currency trading can be volitile and unpredictable. With the rice off cryptocurrencies such as Bitcoin, Ethereum, and others, the market has...

Understanding Price Action: A Focus On Dogecoin (DOGE)

Understand the price campaign: an approach in Dogecoin (Doge) The world of cryptocurrency has become increasingly complex and volatile in recent years, and prices fluctuate quickly in online exchanges. An...

The Importance Of Community Engagement In Crypto Projects

Here is a break in the importation of community engagement in cryptography projects: What is a community commitment crucial Participation of pre-sale : Many projects holde presale their official bill,...